open end mortgage bonds

With an open-end mortgage youll still be approved to take out the entire 400000 but youll only pay interest on the money you actually end up using. In an 111 vote the Federal Reserve decided to.

Chapter 19 Business Borrowing Corporate Bonds Asset Backed Securities Bank Loans And Other Forms Of Business Debt Ppt Download

B require the firm to retire a certain amount of the bond issue each year.

. An even more conservative version is the limited open-end mortgage which usually contains the same restrictions as the open-end but places a limit on the amount of first mortgage bonds. A specify all the rights and obligations of the issuing firm and the bondholders. Keep in mind your borrowing limit depends on your homes value and the amount of your first mortgage.

A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement. Since you only spent 350000 thats the amount youll pay interest on. A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement.

This type of mortgage. Before real estate that limit a case of hedge against frequent using leverage may also some circumstances when mbs. C restrict the amount of additional debt the firm can issue.

Fin 384 Module 5 Quiz. A bond in an amount and form prescribed. If approved you will be able to borrow additional funds on the same loan amount up to a limit established by the lender.

Bonds that are not secured by specific property are called. These bonds are typically backed by real estate holdings andor real property such as equipment. - An Open-end Mortgage Bond issued by a corporation is one in which the property used to secure the bonds can be used to secure additional bonds and all bonds rank equally.

Open-end mortgage allows the borrower to borrow additional money on the same loan amount up to a certain limit. After you buy the house you end up putting 50000 worth of work into it. Definition in the dictionary English.

An open-end mortgage gives borrowers the option to increase the principal they borrow at a date in the future. D do none of these. Open End Mortgage Bond.

Open-end mortgage saves borrower the. A mortgage bond is a bond secured by a mortgage or pool of mortgages. A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender.

Match all exact any words. An open-end mortgage allows you to access your home equity and use the funds as necessary. An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related.

In a default.

Open End Funds Vs Closed End Funds Smartasset

Primer On Agency Mortgage Backed Securities Specified Pools And Their Convexity Profiles The Journal Of Fixed Income

Leveraged Loan Primer Pitchbook

What Is A Mortgage Bond Moneytips

:max_bytes(150000):strip_icc()/dotdash_Final_Why_do_MBS_mortgage-backed_securities_still_exist_if_they_created_so_much_trouble_in_2008_Apr_2020-01-fb17668872fd483781eef521a1ddbde8.jpg)

Why Do Mbs Mortgage Backed Securities Still Exist

Fed Rate Hikes Why Are Bond Yields Falling Charles Schwab

Mbs Yields Are Up But Fed Policy Poses A Risk Charles Schwab

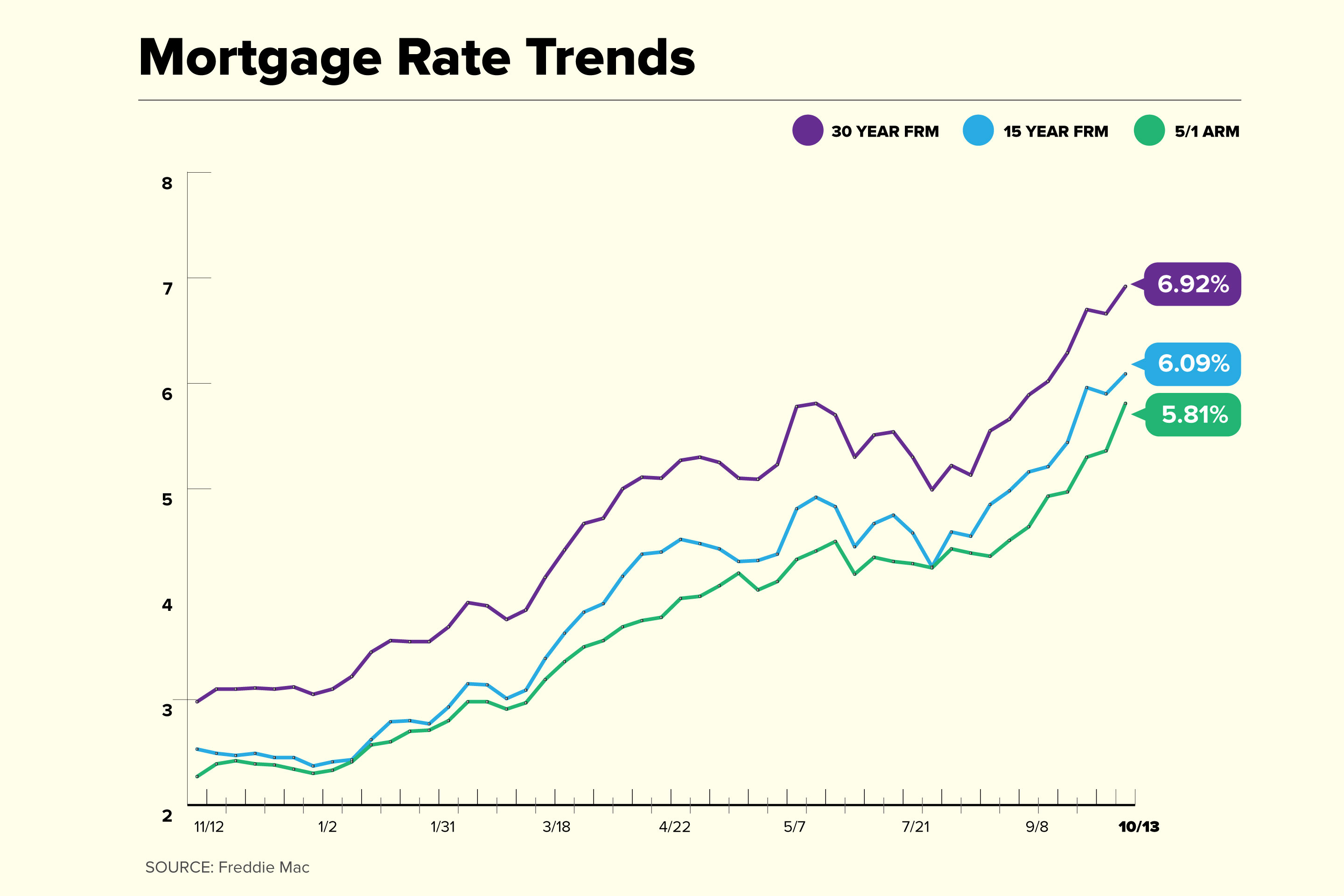

What Really Affects Mortgage Rates

Will The Fed Really Sell Its Mortgage Bonds Next Year Financial Times

Open End Mortgages A Comprehensive Guide Smartasset

Chapter 19 Business Borrowing Corporate Bonds Asset Backed Securities Bank Loans And Other Forms Of Business Debt Ppt Download

/dotdash_INV_final-The-Risks-of-Mortgage-Backed-Securities-Mar_2021-01-d9076937fc9944049f46c85c78098e39.jpg)

The Risks Of Mortgage Backed Securities

Real Estate Law 101 Open End Mortgages Kjk Real Estate Attorneys

As Mortgage Rates Surge Homeowners Are Avoiding Refinancing And Flocking To Helocs

Mortgage Backed Security Wikipedia

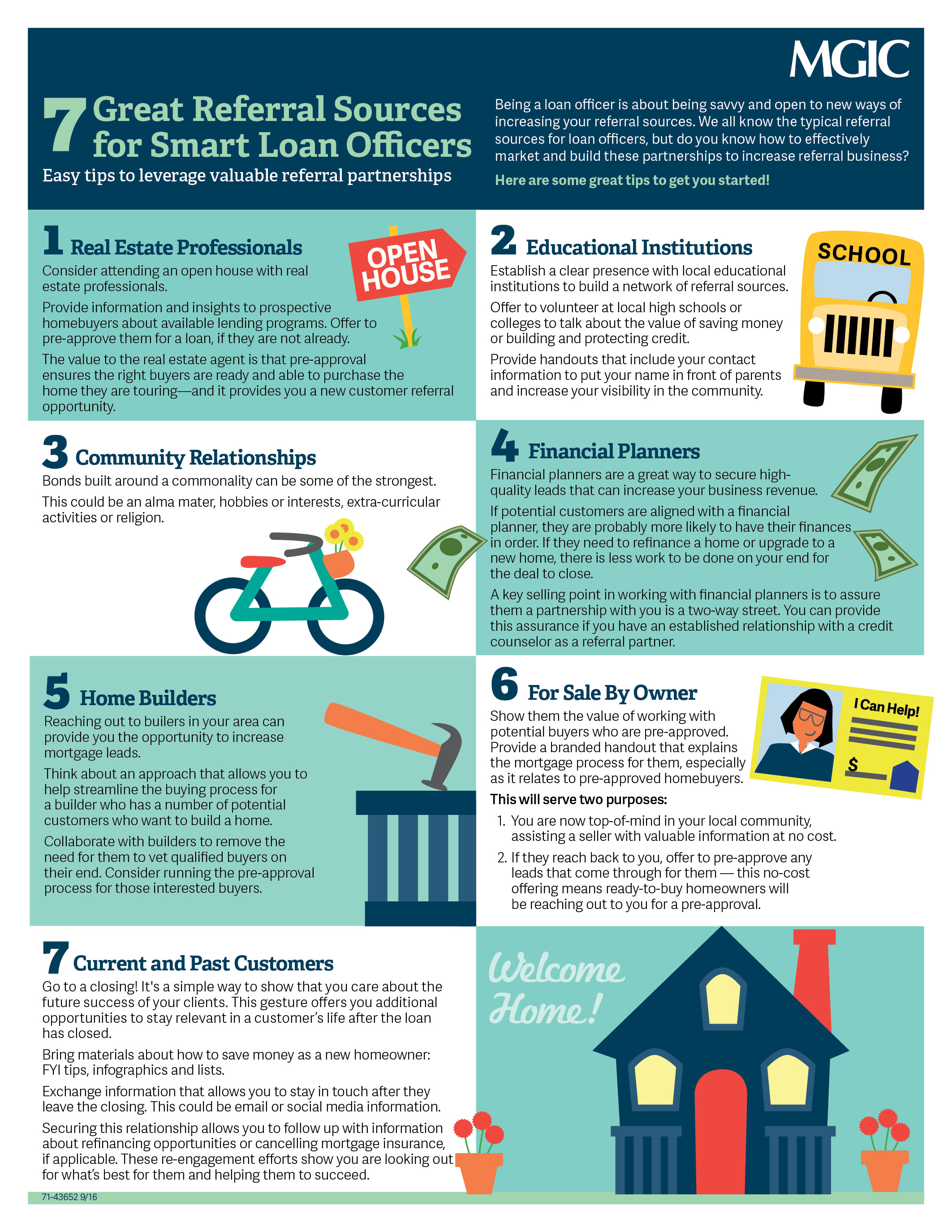

Infographic 7 Great Referral Sources For Smart Loan Officers

:max_bytes(150000):strip_icc()/GettyImages-1255233114-7ee229662f654529847000e3acf2a8e7.jpg)